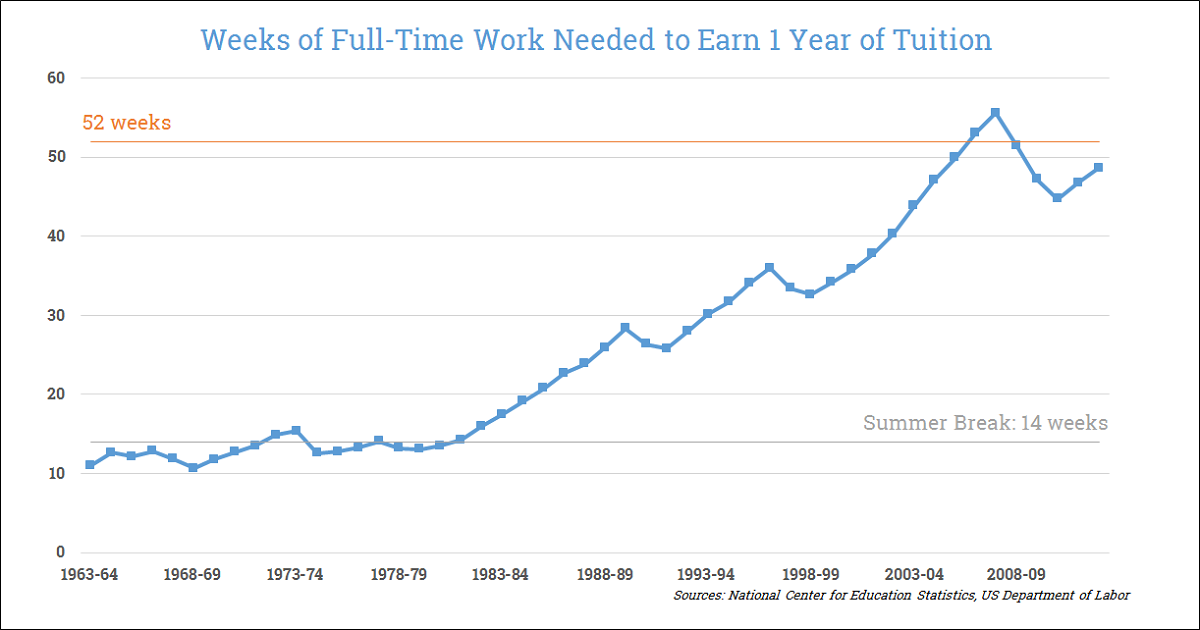

“Back in my day, I paid for my college by working hard all summer.”

It is hard for most students to image a time where you could cover your tuition expenses by working a summer job. When I was going through school in the mid-nineties, I remember working each summer just hoping that I would make enough money to cover my school supplies, books, and spending money to get me through the year.

This chart shows us:

1. The minimum wage has not kept up with the inflation rate of education. Most students work entry-level jobs during the summer that make minimum wage. Here is a chart that displays the percentage of inflation just from recent years (2003-2013, Source)

2. We need to guide emerging adults to set goals for your summer employment that are reachable, concrete, and encouraging. For example, “My goal for this year is to cover my books, and spending money for the year.” The gap between their wages and debt demotivates them to get a summer job. When you know that you are not going to make enough to make a difference in your fall loan balance, it can be discouraging.

3. Provides an understanding of the financial obstacles that cause emerging adults to drop out of college. While more people are attending college each year, more are not able to finish – often due to financial reasons. The inflation rate of education is only one of the financial difficulties that emerging adults face after they leave high school. I believe that it is essential for the church to understand the obstacles they face if we are to make them feel welcome in our churches.

Dr. G. David Boyd is the Founder and Managing Director of EA Resources, who after writing this blog entry just texted a thank you note to his father for helping him make it through college.

Dr. G. David Boyd is the Founder and Managing Director of EA Resources, who after writing this blog entry just texted a thank you note to his father for helping him make it through college.